Navigating the 2025 US Holiday Calendar: A Guide for the NYSE

Related Articles: Navigating the 2025 US Holiday Calendar: A Guide for the NYSE

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 US Holiday Calendar: A Guide for the NYSE. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 US Holiday Calendar: A Guide for the NYSE

The New York Stock Exchange (NYSE), a global financial powerhouse, operates within the context of the US holiday calendar. Understanding the interplay between trading days and observed holidays is crucial for investors, traders, and market participants. This guide provides a comprehensive overview of the 2025 US holiday calendar, highlighting its impact on NYSE operations and offering insights for informed decision-making.

Understanding the Impact of US Holidays on the NYSE

The NYSE, like other financial markets, observes various US holidays, resulting in market closures. These closures impact trading activity, price movements, and overall market liquidity.

Key Considerations for Market Participants:

- Trading Halts: The NYSE remains closed on all observed US holidays. This means no trading occurs, and market data is unavailable.

- Trading Volume: Prior to a holiday, trading volume often decreases as market participants adjust their positions. Similarly, after a holiday, the market may experience increased volatility as participants re-enter the market.

- Price Fluctuations: Market closures can lead to price gaps, where the opening price on the next trading day differs significantly from the closing price on the preceding day.

- News and Events: Major economic releases or news events occurring during market closures can significantly impact market sentiment and price movements upon reopening.

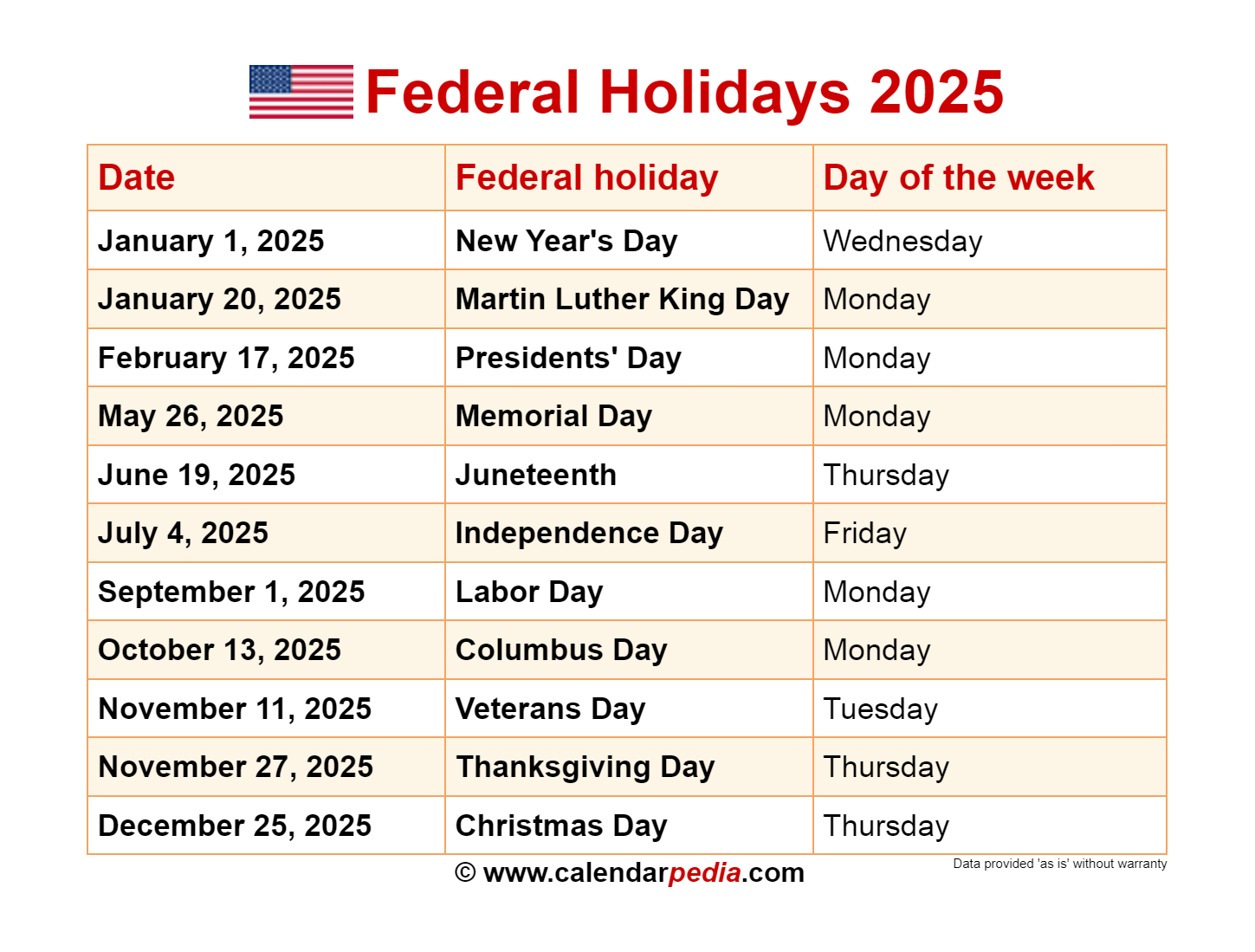

2025 US Holiday Calendar: A Detailed Breakdown

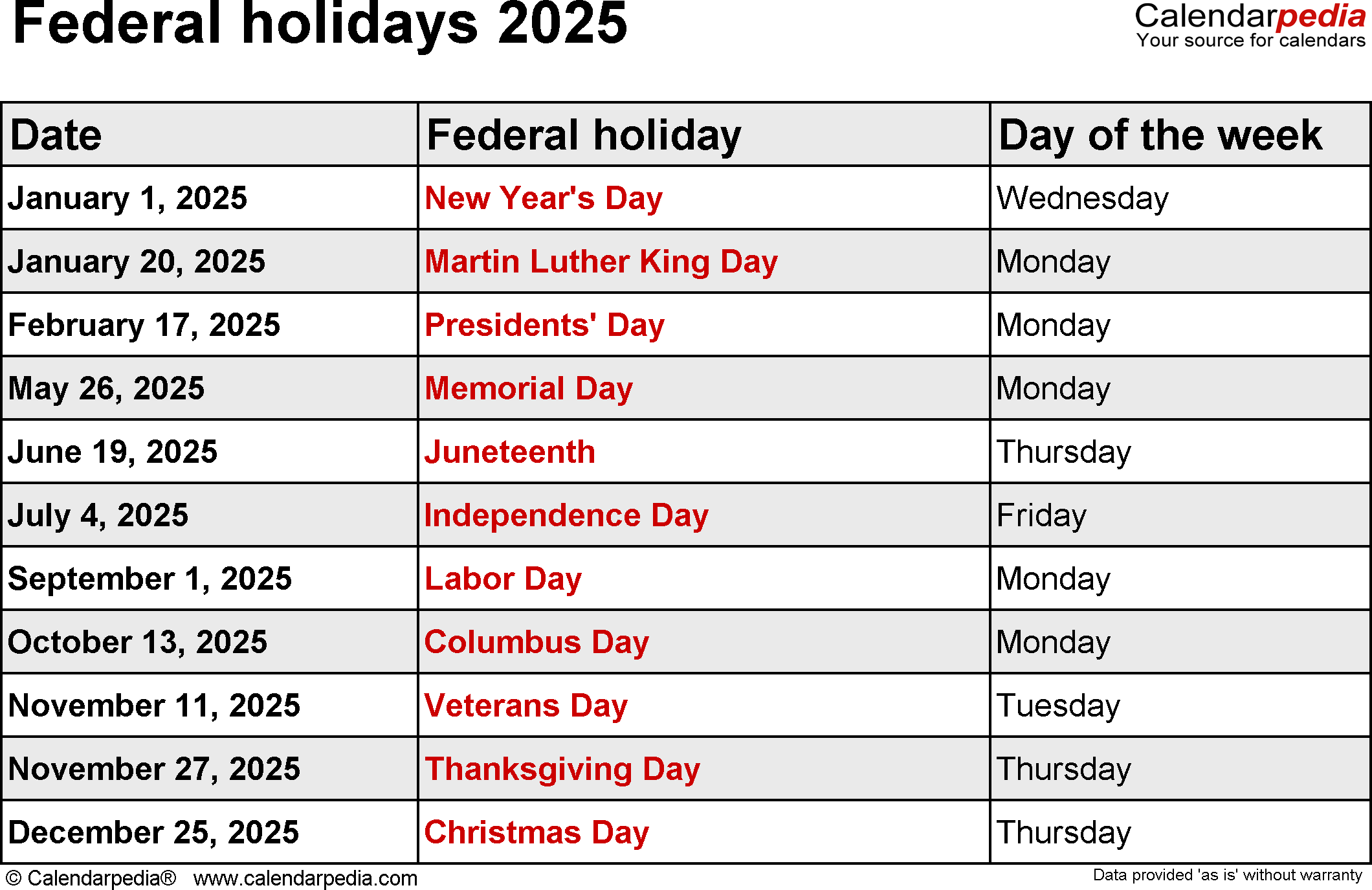

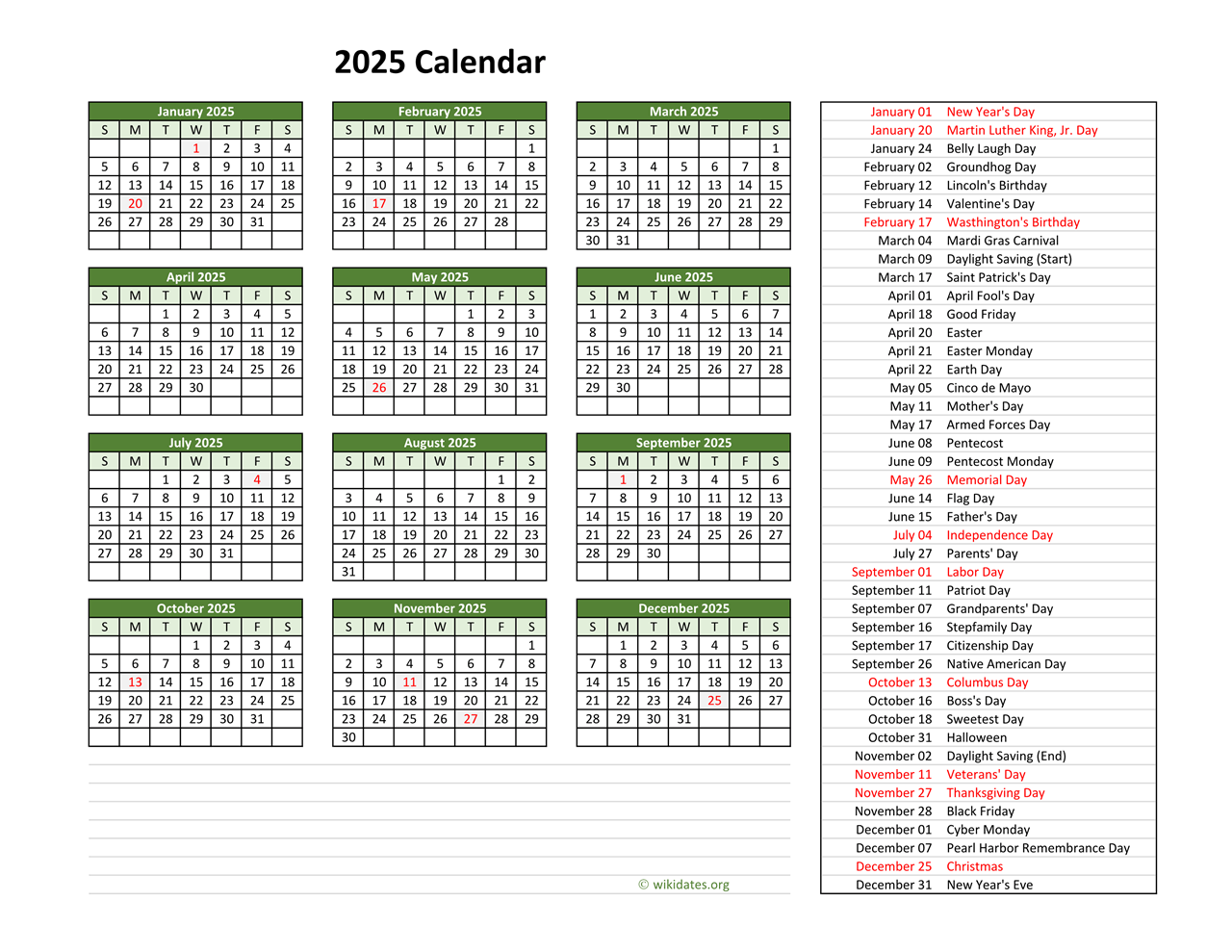

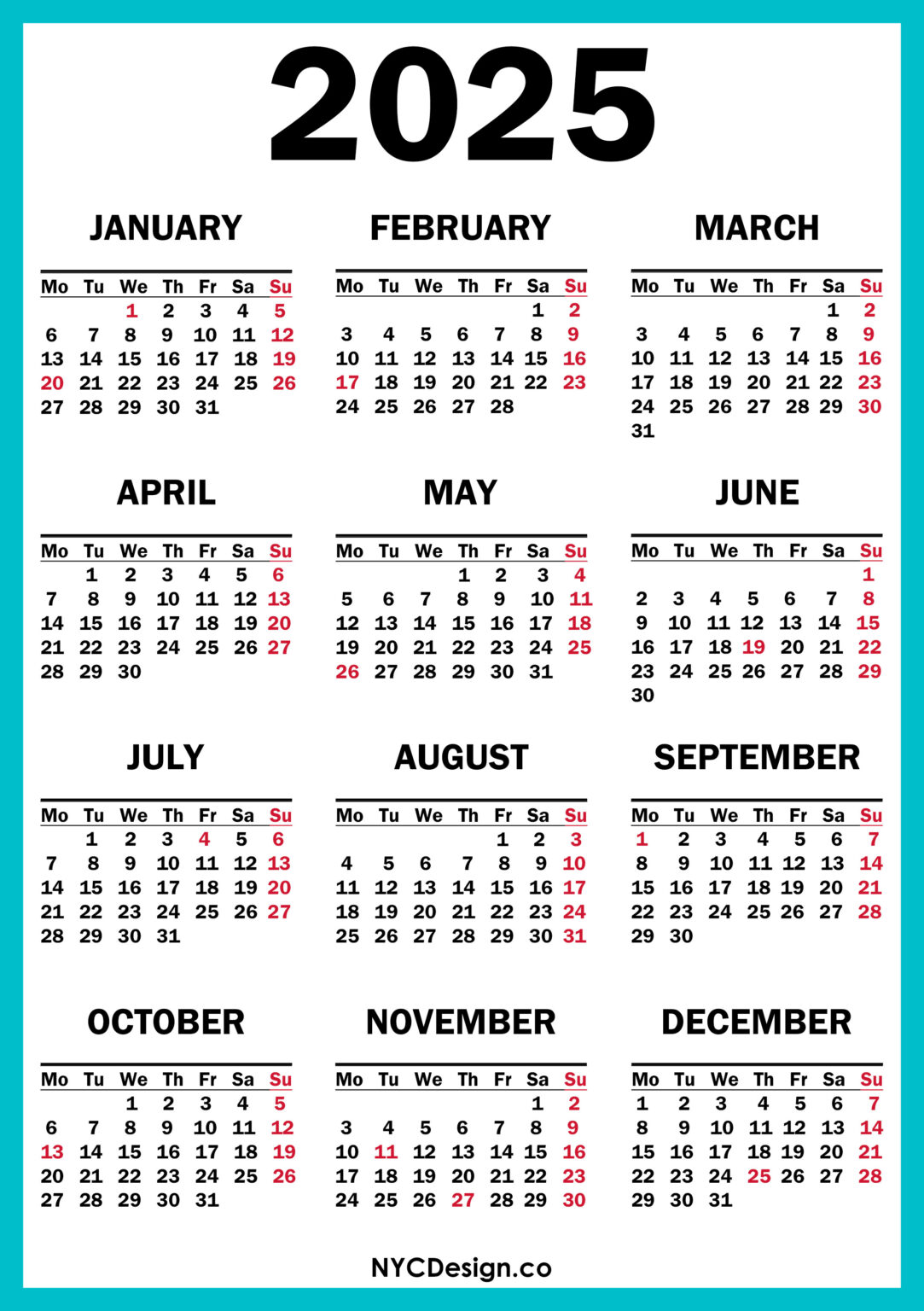

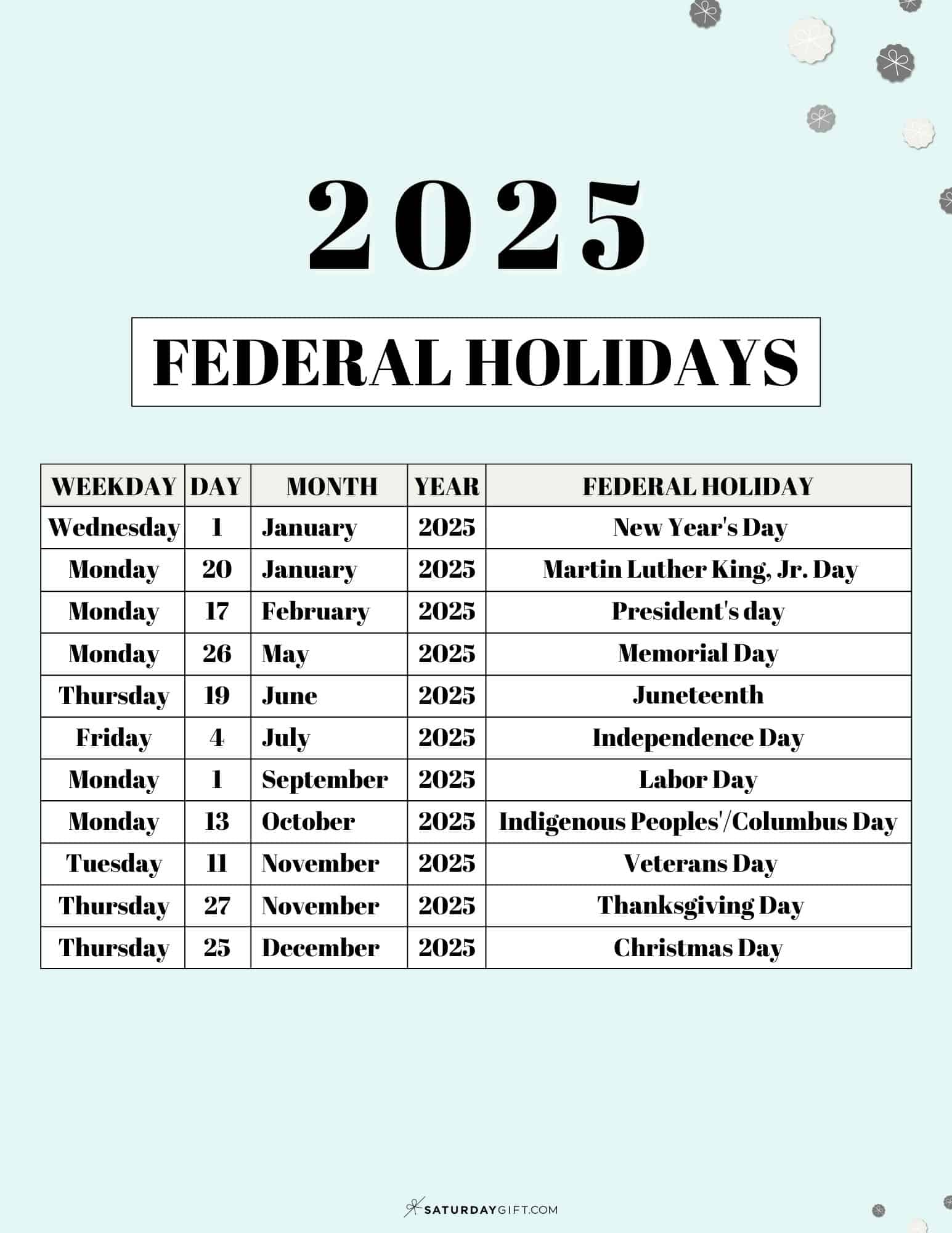

The following table outlines the 2025 US holidays observed by the NYSE, providing information on their dates and potential market implications.

| Holiday | Date | Market Impact |

|---|---|---|

| New Year’s Day | January 1st | Market Closed |

| Martin Luther King Jr. Day | January 20th | Market Closed |

| Presidents’ Day | February 17th | Market Closed |

| Memorial Day | May 26th | Market Closed |

| Independence Day | July 4th | Market Closed |

| Labor Day | September 1st | Market Closed |

| Thanksgiving Day | November 27th | Market Closed |

| Christmas Day | December 25th | Market Closed |

Additional Considerations:

- Early Closures: The NYSE may observe early closures on certain holidays, such as Christmas Eve or the day before Thanksgiving.

- Trading Hours: While the NYSE is closed on holidays, other global markets may remain open, potentially impacting US market sentiment and price movements.

Frequently Asked Questions (FAQs)

1. What happens to my orders placed on a holiday?

Orders placed on a holiday will be automatically queued for execution on the next trading day.

2. How can I access market data during a holiday?

Market data is unavailable during NYSE closures. However, you can access historical data through various financial data providers.

3. Do holidays impact options trading?

Yes, options trading is also suspended during NYSE closures.

4. Are there any exceptions to NYSE closures on holidays?

While the NYSE generally observes all US holidays, there may be occasional exceptions for specific events or market conditions.

5. What are the best practices for navigating holidays as a market participant?

- Stay Informed: Monitor news and announcements regarding potential market closures or schedule changes.

- Plan Ahead: Adjust trading strategies to account for holiday closures and potential market volatility.

- Manage Risk: Consider implementing risk management strategies to mitigate potential losses during periods of increased market volatility.

Tips for Successful Trading During Holiday Periods

- Reduce Exposure: Consider reducing overall market exposure in the days leading up to and following holidays.

- Focus on Liquidity: Prioritize trading in liquid assets with robust market depth to minimize price slippage.

- Monitor News: Pay close attention to news and events that could impact market sentiment during holiday periods.

- Seek Expert Advice: Consult with financial advisors or market experts for personalized guidance on navigating holiday-related market dynamics.

Conclusion

The 2025 US holiday calendar plays a significant role in shaping NYSE operations and market activity. By understanding the impact of holidays on trading, investors, traders, and market participants can make informed decisions, manage risk effectively, and navigate potential market volatility. Staying informed, planning ahead, and seeking expert advice are crucial for navigating the complexities of holiday-related market dynamics. This comprehensive guide provides a valuable resource for navigating the 2025 US holiday calendar and maximizing success within the NYSE ecosystem.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 US Holiday Calendar: A Guide for the NYSE. We appreciate your attention to our article. See you in our next article!